32+ income calculation for mortgage

Web Want a quick way to determine how much house you can afford on a 40000 household income. Mortgage companies and loan underwriters will look at your monthly income from a variety of angles.

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

However lenders prefer a debt-to-income ratio lower than 36 percent with no more than 28 percent of that debt as a mortgage or rent payment.

. Get an idea of your estimated payments or loan possibilities. Web If you borrow 200000 for 30 years at 7 your monthly mortgage payment will be 133060. PITI 300 100 133060 173060 How does our PITI mortgage calculator work.

Estimate Your Monthly Payment Today. The calculator is mainly intended for use by US. On a monthly basis this would add 1000 a month to your usable income.

With this calculator you can find several things. Maximum monthly payment PITI is calculated by taking the lower of these two calculations. Web Most lenders require a borrower to keep housing costs at or below 28 of their pretax income.

Web 352 - 253. Ad See how much house you can afford. Get Your Home Loan Quote With Americas 1 Online Lender.

Get Your Home Loan Quote With Americas 1 Online Lender. Web A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses. Web A 325000 house with a 5 interest rate for 30 years and 16250 5 down will require an annual income of 82975.

More Veterans Than Ever are Buying with 0 Down. All thats left to do is to add together these three terms to get your PITI estimation. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and your total monthly debt including your anticipated monthly mortgage payment and other debts such as car or student loan payments should be no more than 43 of your pre.

The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. Your total monthly income in this example would be 6000. Now say your gross monthly income is 5000.

Monthly Income X 28 monthly PI. Web That gives you a total of 1600 in monthly obligations. Web This debt to income calculator will assist you in estimating your monthly income for mortgage preapproval and determining the debt to income ratio.

Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount. In some cases Lenders may exceed the 28 36 guideline if the borrower meets certain requirements. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

Ad Compare Home Financing Options Online Get Quotes. Web The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt. Ad Compare Home Financing Options Online Get Quotes.

TI Monthly Income X 36 - Other loan payments monthly PI. Web This includes your principal interest real estate taxes hazard insurance association dues or fees and principal mortgage insurance PMI. Web As a customary rule 43 percent is the highest debt-to-income read DTI ratio a borrower can have and still be qualified for a mortgage.

Web An annuity is an investment that provides a series of payments in exchange for an initial lump sum. There are options to include extra payments or annual percentage increases of common mortgage-related expenses. You would calculate your DTI as follows.

The first step to prequalify for a mortgage loan is to calculate your monthly income. Multiply the result by 100 and you have a DTI of 32. The payment that would deplete the fund in a.

But our chase home affordability calculator can help refine and tailor the estimate of how much house you can afford based on additional factors. To include liabilities and determine what you can afford use the calculator above. Total monthly debt payments including housing costs normally should not exceed 36 of pretax income.

The exact formula implemented in this PITI calculator is. Estimate your monthly mortgage payment. Try our mortgage calculator.

Web Add 9000 and 15000 then divide by two to get 12000 for a two year average. Estimate your monthly mortgage payment. Use our mortgage income calculator to examine different scenarios.

Were not including monthly liabilities in estimating the income you need for a 325000 home. Ad See how much house you can afford.

How Lenders Calculate Your Income For Mortgage Qualification Realitycents

Julia Azzopardi Mortgage Broker In Paradise Point Mortgage Choice

Passive Income Update For Financial Freedom 2016 Financial Samurai

Mortgage Blog News And Tips Valley West Mortgage

Economist S View Income Distribution

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Vital Aspects Of Your Credit Health Valley West Mortgage

Mortgage Minimum Income Requirements Calculator Home Loan Qualification Calculator

Solved Exhibit 9 8 Housing Affordability And Mortgage Chegg Com

Mortgage Calculator Enter Your Income See Your Home Price Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Blog News And Tips Valley West Mortgage

What Are Business Expenses Examples Working Taxation Trackers

Vr38d0ije8xwrm

Ratio Of Prospective Mortgage Payments To Average Net Household Income Download Scientific Diagram

Open Esds

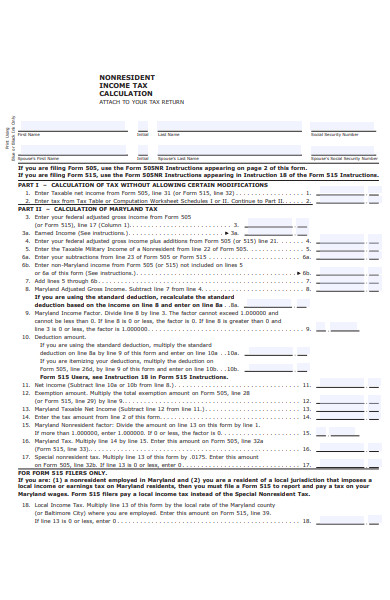

Free 31 Calculation Forms In Pdf Ms Word

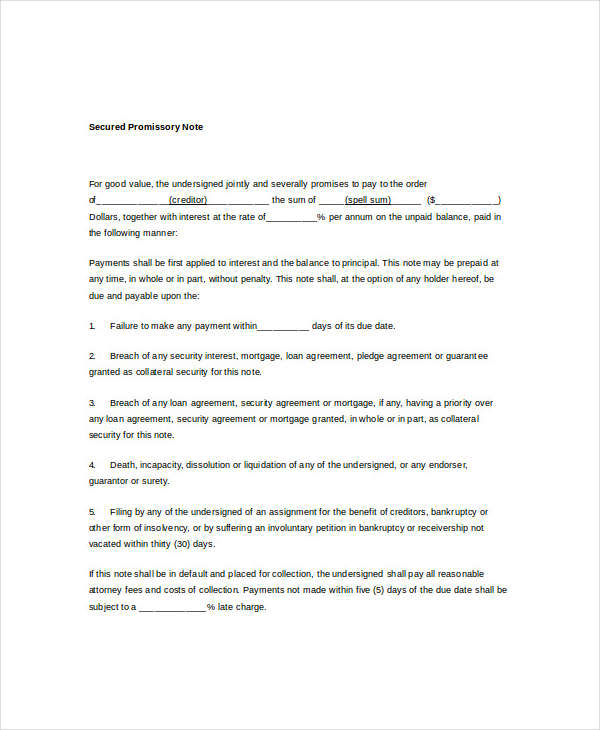

Mortgage Note 6 Examples Format Pdf Examples